For the Chief Financial Officer (CFO) in the retail world, success is measured in one critical metric: profitable inventory.

The complexity of modern retail-omnichannel sales, rapid consumer shifts and global supply chain volatility - has turned the traditional Merchandise Financial Planning (MFP) process into a chaotic, spreadsheet-driven nightmare.

The consequence is value leakage:

The secret to overcoming this challenge and achieving consistent, AI-driven profitability is a fundamental shift in planning: Introducing Anaplan’s Merchandise Financial Planning (MFP), powered by Polaris.

Merchandise Financial Planning (MFP) is the strategic retail process designed to align product sales, inventory investment and margin goals with the overall corporate financial plan. At its core, MFP is the translation of high-level financial targets - set by the CFO and the finance team - into a detailed, actionable plan for merchandising and buying teams.

It dictates how much inventory to buy (receipts), when to buy it and how much to sell it for (markdowns and promotional strategy) across different channels, product categories and timeframes (pre-season and in-season). It is a critical mechanism that links the physical movement of goods to the financial outcomes of the organization.

While the terms are often used interchangeably, there is a crucial distinction between general Retail Financial Planning (RFP) and Merchandise Financial Planning (MFP). RFP is the high-level, corporate function led by the finance team - it sets the overall annual and quarterly targets for revenue, ‘Earnings Before Interest, Taxes, Depreciation, and Amortization’ (EBITDA), operating expenses and capital expenditures for the entire business. It is focused on the company's financial statements.

MFP, in contrast, is the operational execution of those financial goals at the product level. It is the critical bridge between corporate targets and the actual buying and stocking decisions made by merchants and buyers. MFP deals with retail-specific metrics like gross margin return on investment (GMROI), inventory turnover, initial markup (IMU) and open-to-buy (OTB). MFP's precision directly dictates the achievement of the RFP's profitability targets.

The key differences between MPF and RFP are broken down in the table below:

The challenge in disconnected organizations is that the RFP team creates the budget in a traditional FP&A tool, and the MFP team manually translates and executes that budget in a siloed merchandising system or, worse, a spreadsheet.

This leads to friction, broken accountability and a slow response time to market changes. Anaplan's Merchandise Financial Planning platform solves this by ensuring the financial goals set in RFP are modeled and executed dynamically within the MFP module, creating a single, integrated plan.

Retail planning demands two things simultaneously: speed to react to in-season trends and granularity to plan down to the SKU, location and week.

Legacy systems and spreadsheets simply cannot deliver both. They force a trade-off, which always results in missed opportunities.

This is where Anaplan’s core innovation comes into play.

Introducing Polaris.

In the context of Merchandise Financial Planning (MFP), Polaris is Anaplan's proprietary, high-performance calculation engine that acts as the essential technological foundation. It is the core secret that allows retail enterprises to achieve the speed and scale required for profitable planning in today’s complex, omnichannel world. Polaris enables planners to build and manipulate models that incorporate the immense complexity of retail - including millions of product-location combinations, deep product hierarchies, and real-time sales data - without any performance lag.

When a buyer or planner adjusts a single variable, like a markdown percentage for a category or a receipt date, Polaris instantly recalculates the entire, interconnected plan - from the open-to-buy budget to the forecasted gross margin - in sub-seconds. This rapid, real-time recalculation ability eliminates performance bottlenecks, making highly agile scenario planning a reality and fully supporting the demands of AI-driven profitability.

The Polaris Calculation Engine is the technological backbone that eliminates the speed-granularity trade-off.

Anaplan’s MFP application takes the raw speed of Polaris and directs it toward the most important retail goal: optimizing margins.

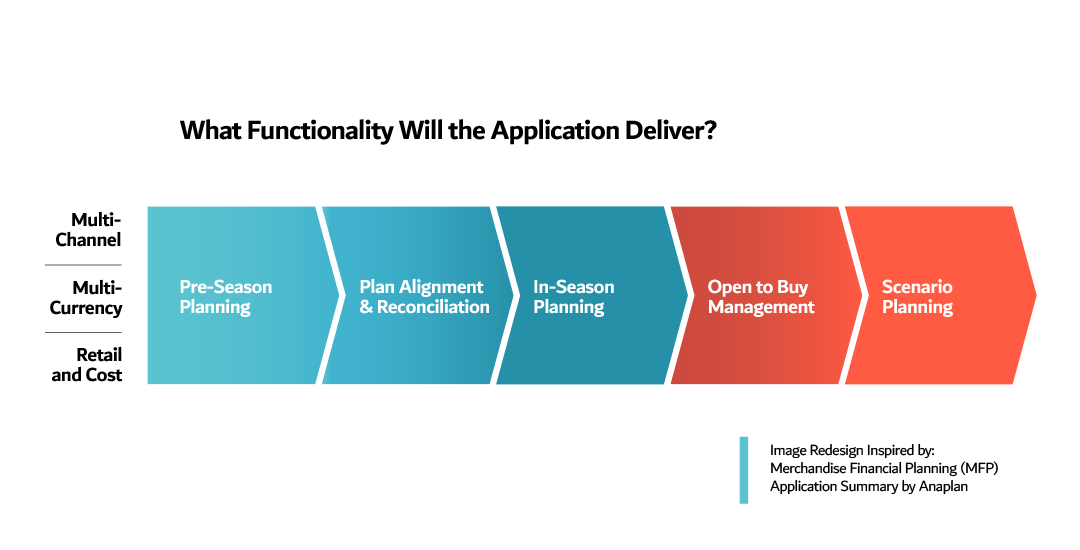

MFP goes beyond simply planning sales and receipts; it’s a connected financial model that ensures merchandising decisions are directly aligned with corporate financial targets.

The structure provided by Polaris and MFP is the essential foundation for advanced intelligence. Clean, structured and fast data is the oxygen that feeds machine learning.

Anaplan leverages this foundation to deliver true AI-driven profitability by focusing on two key outcomes:

Traditional forecasting relied on historical averages. Anaplan’s AI capabilities, such as Anaplan Forecaster, leverage machine learning to:

The CFO's ultimate secret is turning planning into prescriptive action. Anaplan's AI goes beyond prediction to offer a recommended path to maximum margin:

For the CFO of a retail enterprise, the combination of Polaris-powered MFP is more than a new tool; it’s a fundamental competitive advantage. It shifts the entire organization from being reactive (managing markdowns after the fact) to proactive (prescribing the path to profitability).

It allows the finance and merchandising teams to finally speak the same language, work from the same unified plan and leverage the most advanced AI capabilities to make inventory their greatest asset, not their biggest liability.

The modern retail CFO's secret to sustained profitability lies in adopting Anaplan's Polaris-powered Merchandise Financial Planning (MFP) to overcome market volatility and omnichannel complexity. Traditional planning methods, crippled by siloed spreadsheets and slow data processing, cause severe value leakage through forced markdowns and stockouts. The foundational solution is the Polaris Calculation Engine, which provides the unprecedented speed and scale necessary to handle immense data volume, enabling planning at deep granularity - down to the SKU and store level - with instant, real-time recalculation for responsive scenario modelling.

Merchandise Financial Planning (MFP) is the critical operational layer that translates the high-level financial goals set by Retail Financial Planning (RFP) into executable buying and pricing decisions. While RFP focuses on overall corporate targets (EBITDA and revenue), MFP optimizes the profitability of every dollar invested in inventory using core retail metrics like Open-to-Buy (OTB) and GMROI. By connecting these two planning disciplines on Anaplan's unified platform, silos are broken down, ensuring that merchandising and finance teams are aligned around a single plan to maximize gross margin.

This connected, fast data infrastructure is the prerequisite for AI-driven profitability. Anaplan leverages this foundation with AI capabilities, such as Anaplan Forecaster, to deliver superior demand sensing, predictive forecasting, and prescriptive guidance. The system moves beyond simple reporting to recommending optimal assortment mixes and dynamically adjusting OTB budgets based on real-time market signals. This shift empowers the retail CFO to transform from a reactive scorekeeper to a proactive architect of profit, ensuring capital is efficiently deployed and securing a lasting competitive edge.

Looking to invest in Anaplan MFP software solutions powered by Polaris? Get in touch.