The financial world is set to hit a monumental road bump along its journey as some versions of SAP Business Planning and Consolidation (SAP BPC) are scheduled to reach end of maintenance (EOM) by December 31, 2027. This change will force CFOs to make a swift and strategic move away from their aging tools. The sooner organizations confront the reality of the situation; the sooner they can make a strategic switch to a platform built for real-time consolidation, audit-ready compliance and finance-owned control.

With the looming obsolescence of SAP BPC, the platform is becoming increasingly limited for modern, real-time finance needs, placing the entire financial close process on shaky ground. Sticking with this unsupported, legacy infrastructure past its end-of-maintenance date exposes companies to unnecessary risks in security, compliance and data integrity, making it nearly impossible to confidently meet strict regulatory deadlines and ever-changing accounting standards.

Simply put, ignoring the need to migrate from SAP BPC is no longer just a technical issue-it’s a major business vulnerability that demands immediate action for a reliable and secure financial future.

For those currently entrenched in SAP BPC, the proposed transition path from SAP often feels like a fragmented, costly hurdle, potentially requiring the piecemeal purchase of additional solutions like Group Reporting and SAP Analytics Cloud just to cover basic accounting needs.

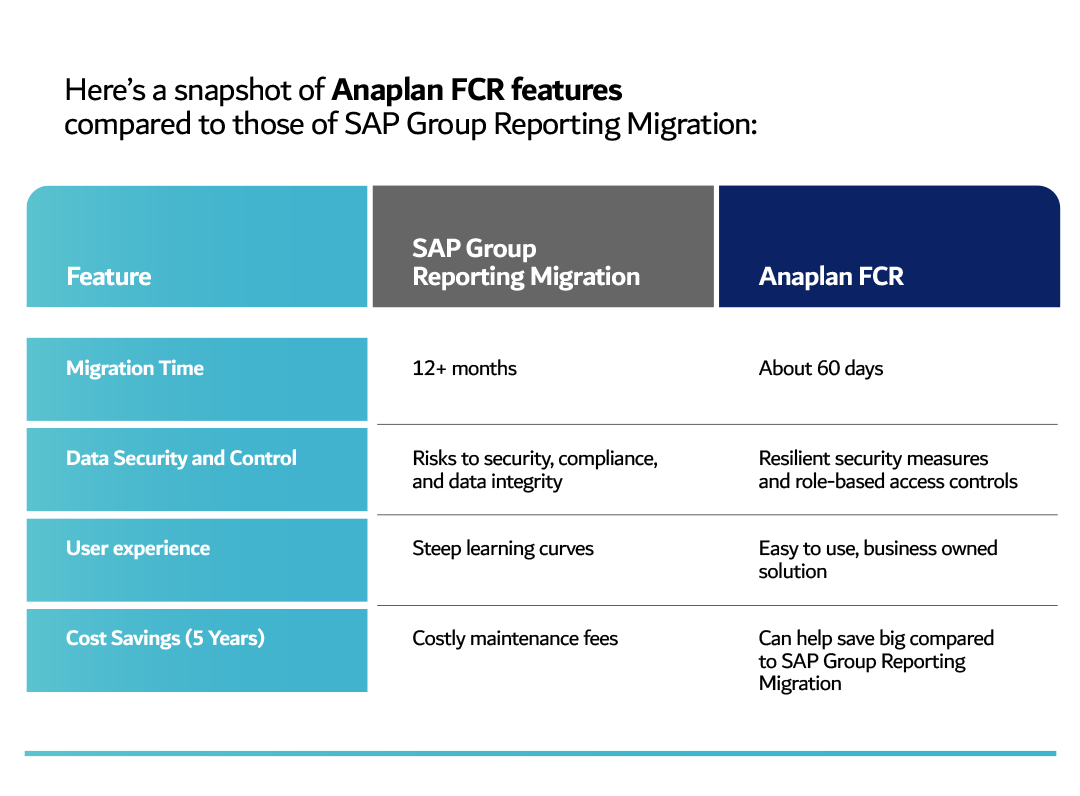

Moreover, adopting SAP S/4HANA across all entities can be a multi-year migration, which ties up valuable resources with lengthy implementation and steep learning curves. This complexity and heavy reliance on siloed systems stand in stark contrast to the agility modern finance requires, highlighting precisely why industry leaders are flocking to the Financial Consolidation application from Anaplan. Anaplan isn't just a swap-out for SAP BPC; it's the foundation for modern finance leadership and the engine for delivering decision excellence.

The move to Anaplan's Financial Consolidation application is a non-negotiable upgrade to a modern, cloud-native platform that seamlessly integrates consolidation and reporting from end-to-end.

Anaplan is designed to drastically improve the accounting tech stack, offering a Pure Play SaaS solution with the resilient security, scalability, high performance and automatic upgrades that SAP never delivered.

The application lets Finance teams close faster with automated workflows, audit-ready transparency and reduced manual effort. This capability grants Finance deeper, quicker insights into the financial drivers of the business, leading to smarter, accelerated decisions.

Anaplan FCR boasts a quick implementation, often having the solution up and running in about 60 days, and its intuitive, Finance-owned design means your team can set up and maintain it without being constantly reliant on IT or external consultants.

While SAP BPC once served as a core financial tool, its legacy architecture has become a roadblock to modern financial agility.

The platform's siloed data models and batch-based updates hinder the real-time visibility required for swift decision-making. Furthermore, SAP BPC’s reliance on Microsoft support, including Excel integration and reporting, is ending in 2026. Compounding this, SAP is planning to charge costly maintenance fees without providing the necessary support and upgrades.

In sharp contrast, Anaplan FCR is built for the complexity and speed of today's market. Here are just a few of the benefits organizations can expect to gain from making the switch to our Anaplan FCR offering:

Anaplan offers controlled and transparent financial operations with role-based permissions and audit trails that go back to the general ledger. Anaplan has an automated migration tool that duplicates all your SAP BPC data, metadata and rules, including dimensions, hierarchies, mapping tables and all rules (opening, conversion, calculation, validation and intercompany).

As is abundantly clear, Anaplan is a robust, flexible Financial Consolidation and Reporting solution that acts as a single source of truth required to meet organizations’ regulatory requirements and is designed to help Finance teams function at their optimal and CFOs lead with extraordinary confidence. Organizations would be remiss in failing to act swiftly to make the switch from SAP BPC to Anaplan FCR, regardless of whether the SAP BPC end of maintenance date was fast approaching or not.

Transitioning to Anaplan FCR is not just an IT project; it's a strategic decision that empowers CFOs to lead with confidence in an increasingly volatile market. The platform is designed to optimize decision-making and build connections and collaboration across organizational silos.

For organizations making this switch, the benefits are immediately tangible.

Anaplan helps streamline group consolidation and reporting by reducing manual workloads, accelerating close timelines and boosting accuracy across entities by providing a single source of truth.

For example, Anaplan's difference is clear in the potential for significant savings: the company can help organizations save on what they are already spending on BPC (47%) and on Group Reporting migration costs (59%). More than 2,500 of the world's best brands continually optimize their decision-making by planning with Anaplan, positioning it as the solution top Accounting teams ask for.

Explore how Anaplan FCR can transform your consolidation and reporting - connect with us to learn more.